Markets fluctuate

We don’t

Rock-solid wealth management strategies built thoughtfully around you

Think beyond financial planning

While many wealth advisors follow stock market fads, Kanos Capital Management brings decades of intelligent and uncommonly disciplined market expertise to the table. Our strategies are based on comprehensive research, fundamentally structured according to long-term objectives and built exclusively around your unique needs, goals, and risk management criteria. Through customized portfolio management, we use a value framework, incorporating both fundamental and technical analyses.

Whether you’re a business owner, an entrepreneur, or just looking to build your family’s wealth, your financial future can benefit from a wider perspective. Kanos provides advice on asset allocation, investment management, and financial advice. We can also give you our opinions on estate planning, tax, and our legal experiences.

Our portfolios are based on institutional-quality research—research that goes beyond what is often used to pick stocks in client portfolios at other firms. In the United States alone, there are 3,800 stocks; yet, the same 100 stocks appear in roughly half of all portfolios, simply because of a herd mentality that exists among many investment firms. That translates to a lot of missed opportunities. We invest in stocks that feature a combination of excellent future prospects and good economic fundamentals. And we make it a point to watch the company, not just its stock price.

Named by Texas Monthly

magazine “Five-Star Wealth Managers,” 2013-2023

As veteran investors, we offer guidance based on decades of experience with investment cycles, trading expertise, and capital management. We build a personalized portfolio to reflect your risk profile, structured in a way to keep our fees and your taxes low.

Over time, your portfolio investments may include equities, fixed income, commodities, currencies, and other publicly traded securities—adjusted as your needs evolve or as new market opportunities present themselves. And when you have questions, we’re here with answers.

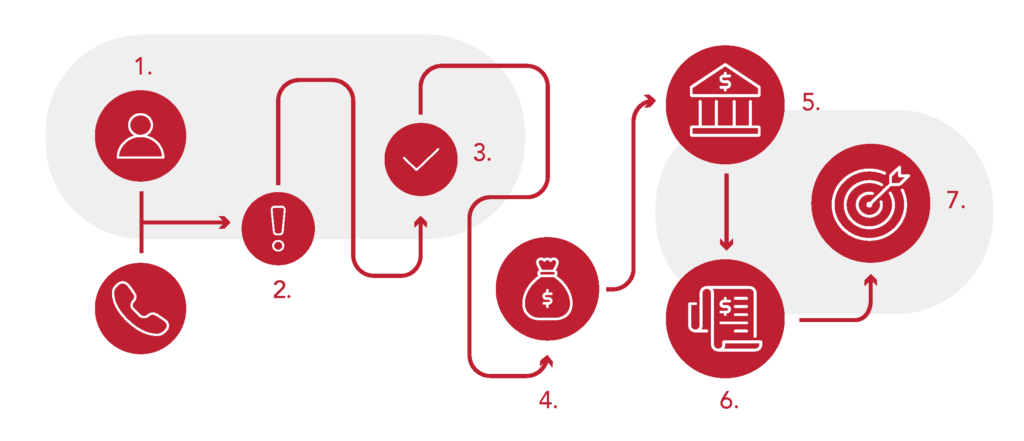

Our Wealth Management Process

- We meet face to face or by phone.

- We listen, to understand your needs, expectations, and risks.

- We propose an investment solution based on that unique criteria.

- Once you agree to our proposal, you apply for a brokerage account(s).

- We construct your customized portfolio, reviewing performance frequently and adapting as necessary.

- Every quarter, we report results and provide thoughts on future investment movements.

- Annually, we meet to review goals and performance.